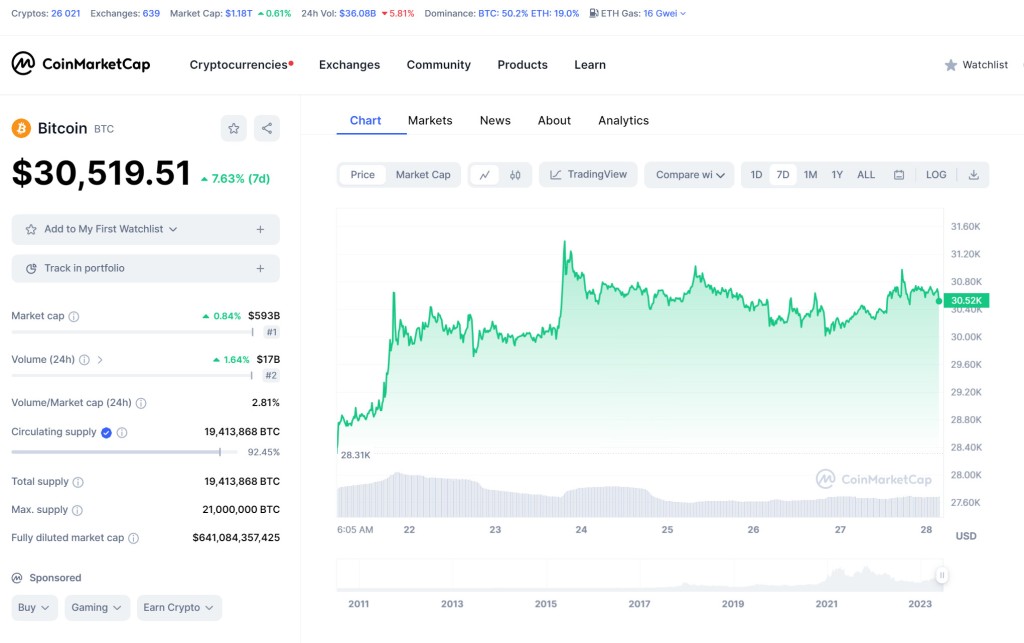

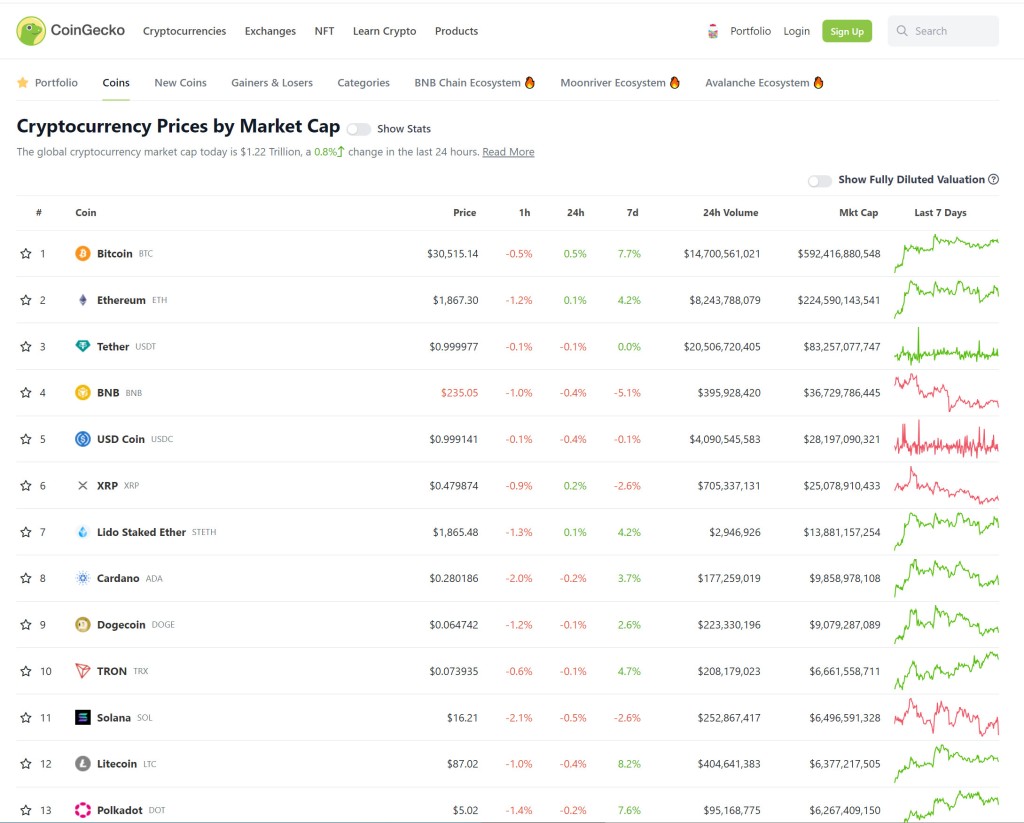

On June 28, the quotes of the first cryptocurrency exceeded $31,000. Over the past day, the asset has risen in price by 4.2%, according to CoinGecko.

At the time of writing, the price is holding above $30,500.

Following the flagship, all assets from the top 10 by capitalization moved into the “green zone”. Significant growth is demonstrated by Cardano (3.6%) and Dogecoin (3%). Over the past day, Ethereum has risen in price by 2.1%.

Market capitalization grew by 3.1% to $1.24 trillion. BTC dominance index – 48.5%, ETH – 18.5%.

The growth of quotes comes against the backdrop of the decision of the US Supreme Court regarding customer lawsuits against Coinbase. The resolution expanded the exchange’s ability to apply to arbitration in resolving such disputes. It does not concern current affairs with regulators and does not directly affect the crypto industry.

According to CoinDesk, on June 23, the US Securities and Exchange Commission (SEC) approved Volatility Shares’ application to launch a 2x Bitcoin Strategy ETF.

On June 21, the first cryptocurrency crossed the level of $30,000. Then the analyst Kevin Peng from The Block Research connected the growth of quotations with optimism amid the submission of an application by BlackRock asset managers to launch a bitcoin ETF.

Earlier, the founder of MicroStrategy, Michael Saylor, predicted a multiple growth of digital gold due to regulation. In his opinion, the actions of the SEC lay the foundation for the next bullish phase.

Former CFTC Chairman Timothy Massad said the future of digital assets hinges on the outcome of SEC lawsuits against cryptocurrency exchanges Binance and Coinbase.

Recall that on June 14, the price of bitcoin began to recover from below $26,000 after the Fed maintained its key rate.